SEARCH LISTED COMPANY

ANY AUS OR NZ COMPANY

SEARCH PRIVATE COMPANY

SEARCH FUNDS

Find any Australian or New Zealand company or fund (dead or alive) by using SEARCH above or go directly to the site:

Institutional investors will usually meet with management before buying; big investors will often catch them at an AGM or phone them.

You don’t need to go to those lengths, but you should check out the people who run a company before you buy its shares.

Who to check and why

Check the qualifications and experience of the key people including the Chief Executive Officer, Chief Financial Officer and the top operating executives of major business segments.

Why? Management has the biggest influence on results, at least in most companies and at least in the long run.

Where to check them

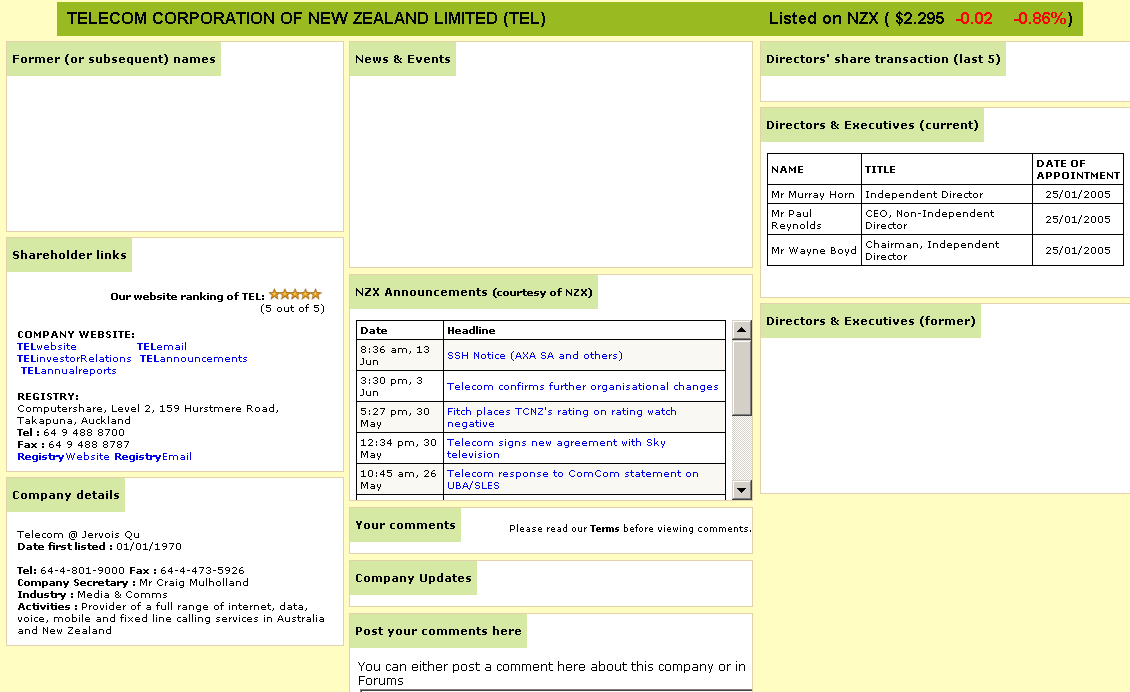

On our website you can simply search on the company and click on executive and director’s names to get Google AUS results. On our website you can also access company websites easily.

On our website you can also access company websites easily.

On company websites look for management profiles and for a record of success in current and previous positions. Satisfy yourself that the people you are going to entrust your money with, are competent and effective. Be wary of people who have been associated with failed companies. Look for managers with an entrepreneurial rather than a caretaker bent.

What else to check

Well-run companies usually attract higher calibre non-executive directors and you should endeavour to see if the company's board has a good mix of experience and expertise. Senior executive and directors shareholdings also often indicate the degree of confidence these people have in the company. Look for their stake in the last annual report and check recent on-market transactions within each company record here on our site.